Nieuws

Wij ontzorgen

Wij staan dichtbij

Wij zijn deskundig

Actueel en nieuws

Onze nieuwsberichten

Rechtbank: niet aannemelijke gehalten dikke fractie ten onrechte vervangen

In de Meststoffenwet is een zogenaamde fraus legis-bepaling opgenomen om evidente schijnconstructies ter ontduiking van de wet tegen te kunnen gaan. Er moet dan vastgesteld worden wat de werkelijke situatie is, na eliminatie van de schijnconstructie.

Subsidieregeling Behoud graslandareaal opengesteld

De subsidieregeling Behoud graslandareaal is opengesteld van 15 juli tot en met 26 augustus 2024. Met de regeling worden derogatiebedrijven ondersteund met het opvangen van de hogere mestafzetkosten, zodat het areaal grasland van deze bedrijven

Vooruitbetaling collegegeld ter verkrijging verblijfsvergunning

In een procedure over de aftrek van scholingskosten heeft de staatssecretaris van Financiën beroep in cassatie ingesteld tegen een uitspraak van de rechtbank Den Haag. De casus is vergelijkbaar met een recente uitspraak van Hof Den

Dienstverlening hospice niet te vergelijken met hotel

In de btw-richtlijn is bepaald dat de lidstaten vrijstelling verlenen voor ziekenhuisverpleging en medische verzorging en daarmee nauw samenhangende handelingen. Deze vrijstelling is in de Wet OB 1968 opgenomen met als omschrijving het verzorgen en

Toepassing werktuigenvrijstelling op zonnepanelen

Een ondernemer huurt het dak van een distributiecentrum om daarop zonnepanelen (hierna: PV-installatie) te leggen voor de opwekking van zonne-energie. De eigenaar van het distributiecentrum heeft voor de ondernemer een recht van opstal gevestigd voor

Nakijken van scripties en onderwijsvrijstelling

Een ondernemer biedt als dienst aan het nakijken van scripties voor studenten. De ondernemer stelt dat deze dienst onder de onderwijsvrijstelling valt en daarom is vrijgesteld van btw. De inspecteur is het hiermee oneens, wat leidde tot een

Flexibele kapitalisatiefactoren bij WOZ-waardebepaling

Op 31 juli 2020 heeft de heffingsambtenaar van de gemeente Amsterdam de WOZ-waarden voor het jaar 2019 vastgesteld van meerdere onroerende zaken, variërend van € 197.000 tot € 1.814.000. De eigenaar van de onroerende zaken heeft bezwaar

Rioolheffing voor een jaarplaats op een camping?

De eigenaar van een caravan heeft een jaarplaats gehuurd op een camping in de gemeente Hilvarenbeek. Zijn caravan is aangesloten op de riolering van het park. De gemeente Hilvarenbeek heeft aan de eigenaar een aanslag rioolheffing opgelegd. De

Btw bij short-stayverhuur: wat ondernemers moeten weten

Een projectontwikkelaar koopt een pand met een winkel op de begane grond en woningen op de bovenliggende verdiepingen. De projectontwikkelaar verbouwt de woningen tot appartementen, die hij voor korte duur gaat verhuren. Hij vraagt de btw over de

Is de vervangingswaarde van bedrijfspanden in- of exclusief btw?

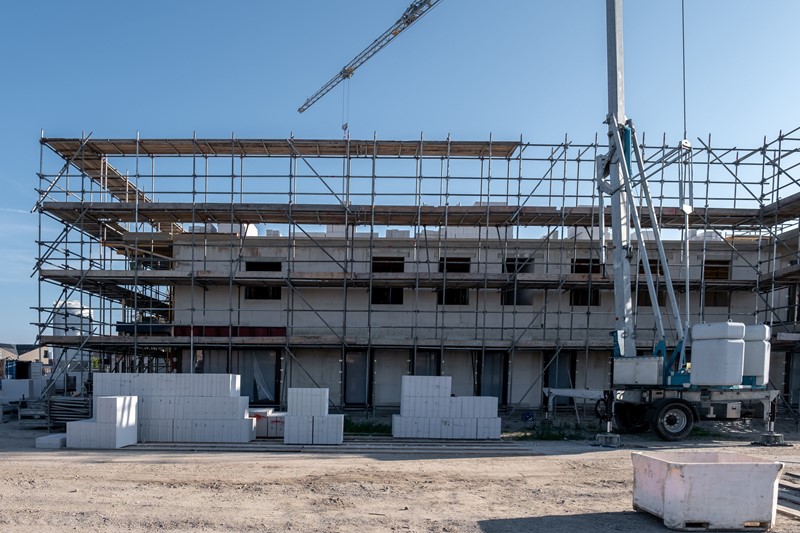

Een eigenaar van een hotel in aanbouw ontving van de gemeente Amsterdam een beschikking waarin de vervangingswaarde van het pand werd vastgesteld op € 36 miljoen. Op basis van deze waarde kreeg de ondernemer ook een aanslag

Regels grasland scheuren

Op klei- en veengrond mag grasland nog tot 15 september vernietigd worden. Indien na het vernietigen van grasland een stikstofbehoeftig gewas geteeld wordt en men dit gewas wil bemesten met een stikstofhoudende meststof, moet uit een representatief

Structurele opzet Investeringsfonds Duurzame Landbouw

In juli 2021 is het Investeringsfonds Duurzame Landbouw (IDL) van start gegaan als een pilot ter ondersteuning van land- en tuinbouwbedrijven die omschakelen naar een integraal duurzame bedrijfsvoering, bijvoorbeeld naar kringloop-, biologische- of

Onderzoek gevolgen beperking vrijstelling groen beleggen per 1 januari 2025

Bij de behandeling van het Belastingplan 2024 heeft de Tweede Kamer een amendement aangenomen om de vrijstelling voor groen beleggen per 2025 te verlagen van € 71.251 naar € 30.000. Het betreft een dekkingsmaatregel voor aanpassingen in de

Verbouwing leidt niet tot nieuw gebouw

Bij de verkrijging van in Nederland gelegen onroerende zaken is overdrachtsbelasting verschuldigd. Er geldt echter een vrijstelling van overdrachtsbelasting wanneer de levering van een onroerende zaak belast is met omzetbelasting. Dat is het geval

Schadeverzekeraar probeert onder verlegde btw uit te komen

Een schadeverzekeraar biedt onder meer autoverzekeringen aan, die binnen de EU de wettelijke aansprakelijkheid bij deelname aan het verkeer dekken. Deze verzekeringen zijn in Nederland vrijgesteld van btw. Bij schade binnen de EU ontvangt de

Hoge Raad komt met nieuwe uitleg van gering financieel belang voor vergoeding immateriële schade

Een persoon probeerde een vergoeding voor immateriële schade te verkrijgen door te stellen dat de invorderingsrente te laag was vastgesteld. Uiteindelijk belandde de zaak bij de Hoge Raad, die een nieuwe aanpak introduceerde om procedures omwille van

Geen belastingplicht voor Immobilien-Sondervermögen in Nederland

Een naar Duits recht opgericht Immobilien-Sondervermögen investeert wereldwijd in onroerende zaken. In 1997 heeft dit beleggingsfonds voor het eerst in Nederland geïnvesteerd in Nederlandse onroerende zaken. Volgens de inspecteur is het

Bezwaar na afwijzen perceel vanwege dubbelclaim

Wanneer een in de Gecombineerde opgave opgegeven perceel ten onrechte is afgewezen vanwege een (niet-opgeloste) dubbelclaim, zal er bezwaar gemaakt moeten worden. Welke bewijsstukken moeten er dan aangeleverd worden?

Eigenaar/gebruiker

De

Invoering elektronisch mestregister

In de huidige derogatiebeschikking is opgenomen dat Nederland met ingang van 1 januari 2024 een elektronisch mestregister moet hebben ingevoerd, waarin het op of in de bodem brengen van minerale meststoffen en de productie van mest en het op of in de

Inzage in fiscaal dossier niet voor 1 januari 2026

Bij de behandeling van het Belastingplan 2024 is een amendement aangenomen dat belastingplichtigen het recht geeft op inzage in het eigen dossier. Dit amendement wijzigt de Algemene wet inzake rijksbelastingen (AWR). De staatssecretaris van Financiën

Bedragen kinderbijslag per 1 juli 2024

De bedragen van de Algemene Kinderbijslagwet worden halfjaarlijks gewijzigd. Met ingang van 1 juli 2024 gelden de volgende bedragen:

De kinderbijslag voor een kind, dat jonger is dan 6 jaar, is € 281,69 per kwartaal.

De kinderbijslag voor

Verlaagd btw-tarief voor verhuur zeiljachten

Een ondernemer biedt een 'all-in' jaarabonnement voor zeiljachten aan en meent dat het verlaagde btw-tarief voor sportbeoefening daarop van toepassing is. De inspecteur stelt echter dat deze dienst belast is met 21% btw. De casus belandt uiteindelijk

Waardestijging woning belast in box 3?

Een inwoner van Duitsland bezit een woning in Nederland. Naar aanleiding van het tumult omtrent box 3 dient hij een verzoek tot ambtshalve vermindering van de aanslagen inkomstenbelasting 2017 en 2018 in. De inspecteur reageert op het verzoek met het

Terugbetaling ten onrechte ontvangen vergoeding geen negatief loon

De rechtbank Gelderland heeft onlangs geoordeeld over de vraag of de terugbetaling van een onterecht ontvangen vergoeding van een ex-werkgever als negatief loon kan worden aangemerkt voor de inkomstenbelasting. Het geschil betrof de aanslag

Vereenvoudigingen conditionaliteiten GLB

De Europese Commissie heeft een vereenvoudiging in het Gemeenschappelijk Landbouwbeleid (GLB) doorgevoerd. Dit biedt de lidstaten meer flexibiliteit bij de toepassing van de GLMC-voorwaarden (conditionaliteiten). Dit zijn goede landbouw- en

Onderzaai vanggewas bij maïs

Na de teelt van maïs op zand- en lössgrond moet voor 1 oktober een vanggewas ingezaaid worden. Hetzelfde geldt voor percelen in met nutriënten verontreinigde gebieden, wanneer deelgenomen wordt aan derogatie. Er geldt een uitzondering als

Teruggaaf energiebelasting

Energiemaatschappijen brengen bij de levering van elektriciteit energiebelasting in rekening bij de afnemer. Het verbruik wordt gestaffeld belast: hoe hoger het verbruik, hoe lager het tarief. Regelmatig wordt er te veel energiebelasting betaald en

Nieuwe pachtnormen per 1 juli 2024

Jaarlijks worden per 1 juli de hoogst toelaatbare pachtprijzen voor akkerbouw- en grasland, tuinland, agrarische gebouwen en agrarische woningen vastgesteld. De nieuwe pachtnormen zijn berekend op basis van de bedrijfsresultaten van middelgrote en

Forse stijging pachtnormen per 1 juli 2024

Jaarlijks worden de hoogst toelaatbare pachtprijzen voor akkerbouw- en grasland, tuinland, agrarische gebouwen en agrarische woningen vastgesteld. Er zijn onlangs nieuwe normen gepubliceerd, welke op 1 juli 2024 van kracht worden.

Los bouw- en

Wederom uitstel startdatum eco-activiteit weiden melkkoeien

De uiterste datum om te starten met weiden is voor melkveehouders die deelnamen aan zowel het Weidemelkschema als de eco-activiteit weiden voor dit jaar verplaatst naar 1 juli. Dit heeft de Stichting Weidegang, in overleg met het ministerie van LNV,

Fiscale implicaties van afgewaardeerde leningen in bedrijfsfinanciën

Een bv verstrekte in 2017 een achtergestelde lening aan een dochtermaatschappij, die zich midden in een financiële crisis bevond. De bv heeft de lening later in hetzelfde jaar afgewaardeerd toen duidelijk werd dat terugbetaling onwaarschijnlijk was.

Villa met praktijkruimte: is de praktijkruimte onderdeel van de woning?

Een echtpaar kocht een villa, die voorheen als woonhuis en praktijkruimte van een huisarts diende, en betaalde 2% overdrachtsbelasting over de koopsom. Echter, toen de inspecteur op de hoogte raakte van de aankoop, legde hij een naheffingsaanslag

Consultatie verplichte arbeidsongeschiktheidsverzekering zelfstandigen

De minister van SZW heeft een wetsvoorstel voor een verplichte basisverzekering voor arbeidsongeschiktheid van zelfstandigen ter consultatie gepubliceerd. Verplichte verzekering is mogelijk via publieke verzekering of via een private verzekering. Een

Inspecteur vernietigt compromis over uitdeling op grond van dwaling

Een bv, die zich bezighoudt met projectontwikkeling en de verhuur van onroerende zaken, verkocht in 2017 een woning voor een te lage prijs aan de zoon van de dga. De woning was sinds 2008 verhuurd aan de zoon voor een huur van € 1.200 per maand.

Mag een bestuursorgaan in hoger beroep terugkomen op eerdere ontvankelijkverkaring bezwaar?

Hof Amsterdam heeft onlangs geoordeeld over de vraag of een bestuursorgaan in een belastingzaak in de beroepsfase alsnog de tijdigheid van een eerder ontvankelijk verklaard bezwaar aan de orde mag stellen, terwijl dit bezwaar inhoudelijk is

Recht op aftrek btw op draagconstructie woning en op zonnepanelen bij verhuur woning?

Een ondernemer voor de omzetbelasting heeft twee woningen laten bouwen. De ene is bestemd als eigen woning en de andere voor de verhuur. De verhuur van een woning is vrijgesteld van omzetbelasting. Het dak van deze tweede verhuurde woning wordt vol

Waardebepaling van aanmerkelijk belang bij remigratie

Een erflater is in 1991 naar België geëmigreerd. In 1994 heeft hij een aanmerkelijk belang van 50% van de aandelen in een Nederlandse bv verkregen. In 2003 remigreerde de erflater naar Nederland. Op dat moment waren de aandelen € 611.640 waard.

Vrijstelling van btw bij doorbelasting aansprakelijkheidsverzekering

Een ziekenhuis berekent een deel van de aansprakelijkheidsverzekering door aan medisch specialisten. De inspecteur is van mening dat sprake is van een dienst en stelt dat deze dienst belast is met het algemene tarief van 21%. Het ziekenhuis stelt

Beloning meewerkende kinderen

Voor kinderen, die meewerken in de onderneming van hun ouders, bestaat een vereenvoudigde regeling om hen hiervoor te belonen, de zogenaamde kalenderjaarregeling (KJ-regeling). Het loon is aftrekbaar van de belastbare winst en leidt binnen bepaalde

Actueel houden perceelregistratie verplicht

In de Uitvoeringsregeling GLB 2023 is uitdrukkelijk opgenomen, dat gedurende het aanvraagjaar wijzigingen in de percelen en de voorgenomen eco-activiteiten onverwijld moeten worden doorgegeven door het opnieuw insturen van de Gecombineerde opgave.

Rente over bijgeschreven rente eigenwoningschuld is niet aftrekbaar

De betaalde rente en kosten van de eigenwoningschuld zijn aftrekbaar. Ook rente, die niet is betaald maar is bijgeschreven op de hoofdsom en daardoor rentedragend is geworden, komt in beginsel voor aftrek in aanmerking. De eigenwoningschuld is het

Geen fictieve verkrijging op grond van verrekenbeding

De Successiewet kent een aantal fictieve erfrechtelijke verkrijgingen. Een van deze verkrijgingen betreft hetgeen aan de langstlevende echtgenoot bij het overlijden van de andere echtgenoot op grond van een verrekenbeding in de huwelijksvoorwaarden

Concurrentiebeding niet langer geldig na wijziging arbeidsovereenkomst

Een concurrentiebeding voor een werknemer moet schriftelijk worden vastgelegd om rechtsgeldig te zijn. Volgens vaste rechtspraak behoudt een concurrentiebeding zijn geldigheid wanneer een bestaande arbeidsovereenkomst na verloop van tijd stilzwijgend

Ook de Wet rechtsherstel box 3 is discriminerend

De Hoge Raad heeft arrest gewezen in een aantal zaken over de belastingheffing in box 3 na de invoering van de Wet rechtsherstel box 3 (Herstelwet). Deze wet is ingevoerd na het geruchtmakende Kerstarrest van de Hoge Raad. In dat arrest heeft de Hoge

Schade-uitkering na klachtenprocedure beleggingsverzekering

Een verzekeringnemer met een beleggingspolis ontvangt na een klachtenprocedure van de verzekeraar een som geld. De verzekeringnemer is van mening dat het een onbelaste schadevergoeding betreft. Het kapitaal uit de beleggingspolis moet worden besteed

Gratis gezonde lunchmaaltijden?

Een werkgever heeft in de jaren 2017 en 2018 vanuit de bedrijfskantine gratis gezonde lunchmaaltijden aan de werknemers verstrekt. De werkgever heeft de kosten ondergebracht in de vrije ruimte van de werkkostenregeling. Over het bedrag, dat niet in

Uitstel begindatum eco-activiteiten

Door het natte voorjaar kunnen sommige eco-activiteiten niet tijdig uitgevoerd worden. De minister van LNV heeft daarom besloten de begindatum van verschillende eco-activiteiten en het inzaaien van een groenbemester bij GLMC 6 uit te

Uitstel openstelling subsidie behoud graslandareaal

De openstellingsperiode van de subsidieregeling Behoud graslandareaal voor derogatiebedrijven is gewijzigd en anderhalve maand opgeschoven. De regeling wordt nu opengesteld van 15 juli tot en met 26 augustus 2024. Belangrijkste reden voor het uitstel

Wetsvoorstel verlaging mestproductieplafonds 2025

De minister van LNV heeft een voorstel tot wijziging van de Meststoffenwet ter consultatie gelegd in verband met de implementatie van de derogatiebeschikking. Allereerst zijn daarin de nationale en sectorale mestproductieplafonds voor 2025 opgenomen.

Levering verhuurd pand

De levering van een nieuw vervaardigde onroerende zaak is van rechtswege belast met omzetbelasting en vrijgesteld van overdrachtsbelasting. Als de verkrijger de nieuw vervaardigde zaak voor van omzetbelasting vrijgestelde prestaties gebruikt, kan hij

Verstrekking op de zaak betrekking hebbend stuk via link naar website

De Gemeentewet biedt gemeenten de mogelijkheid om rechten te heffen voor door of vanwege het gemeentebestuur te verstrekken diensten. Voorbeelden daarvan zijn de leges die worden geheven voor het in behandeling nemen van een aanvraag voor een

Openstelling Sabe-regeling

In 2023 is de Subsidiemodule Agrarische Bedrijfsadvisering en Educatie (SABE) voor het eerst opengesteld in het kader van het Nationaal Strategisch Plan (NS) en het nieuwe Gemeenschappelijk Landbouw Beleid (GLB) 2023-2027. Doel is het ondersteunen

Subsidie investeren in geïntegreerde gewasbescherming

De subsidieregeling investeringen geïntegreerde gewasbescherming wordt dit jaar opengesteld van 20 tot en met 28 juni. Er kan subsidie worden verkregen voor een investering in één nieuw bedrijfsmiddel. Het moet als doel hebben

WA-verzekering voor werkmaterieel

Volgens de Wet aansprakelijkheidsverzekering motorrijtuigen (WAM) moet een eigenaar al zijn motorrijtuigen verzekeren voor wettelijke aansprakelijkheid (WA). Voor de wet is een motorrijtuig een voertuig dat zichzelf motorisch kan voortbewegen en een

Btw-teruggave bouw brede school: heeft de gemeente zichzelf in de voet geschoten?

Een gemeente heeft een brede school laten bouwen. Het gebouw is bestemd voor twee basisscholen, een peuterspeelzaal en een kinderdagverblijf. Bij de ontwikkeling van de brede school waren ook een woningcorporatie en een stichting betrokken. De

Verkoop woning aan bv tegen (te) hoge prijs. Bevoordeling?

Een dga verkoopt in 2015 zijn woning aan zijn bv. Een jaar later verkoopt de bv de woning voor een flink lager bedrag aan de ex-echtgenote van de dga. De inspecteur stelt dat de verkoop aan de bv voor een te hoge prijs is gedaan en legt een

Uitstel voor doen aangifte wel of niet verleend?

De bevoegdheid van de Belastingdienst om een aanslag inkomstenbelasting vast te stellen vervalt drie jaar na afloop van het jaar waarop de aanslag betrekking heeft. Als uitstel voor het doen van aangifte is verleend, wordt de driejaarstermijn met de

Geen cassatie tegen hofuitspraak over invloed vrijgesteld inkomen op ouderenkorting

De staatssecretaris van Financiën ziet af van het instellen van beroep in cassatie tegen een uitspraak van Hof Den Haag over de inkomensgrens voor de ouderenkorting. Volgens het hof mag bij het bepalen van het inkomen voor de toepassing van de

Mee-beregenen aardappelpercelen verboden

Vanaf dit jaar is het voor telers van alle gewassen verboden om naastgelegen aardappelpercelen mee te beregenen als daar een beregeningsverbod geldt. Ook als het zogeheten mee-beregenen niet opzettelijk gebeurt. In de aangepaste Regeling

Uitstel begindatum eco-activiteit ‘groene braak’

Vanwege het natte voorjaar is de begindatum van de eco-activiteit 'groene braak' aangepast van 1 juni naar 15 juni. Het perceel moet nu voor minimaal 80% zichtbaar bedekt zijn van 15 juni tot en met 31 augustus. Dit kan bijvoorbeeld door een

Openstelling Subsidiemodule Agrarische Bedrijfsadvisering en Educatie

In 2023 is de Subsidiemodule Agrarische Bedrijfsadvisering en Educatie (SABE) voor het eerst opengesteld. Doel van de SABE is het ondersteunen van landbouwondernemers, die hun kennis over verduurzaming van de bedrijfsvoering willen vergroten.

In

Kamerbrief aanpassingen in bedrijfsopvolgingsregeling en doorschuifregeling

Bij de behandeling in de Tweede Kamer van het initiatiefwetsvoorstel over de bedrijfsopvolgingsregeling in de schenk- en erfbelasting (BOR) is discussie ontstaan over een amendement, dat afgelopen najaar is aangebracht in de Wet aanpassing fiscale

Fiscale maatregelen in hoofdlijnenakkoord

De formerende partijen hebben een akkoord op hoofdlijnen gesloten, dat als basis dient voor de kabinetsformatie. Dit hoofdlijnenakkoord bevat een aantal fiscale maatregelen en een aantal nog uit te werken voornemens voor fiscale maatregelen. Enkele

Kabinetsreactie op evaluatie onbelaste reiskostenvergoeding

Het ministerie van Financiën heeft onderzoek laten doen naar de onbelaste reiskostenvergoeding in de loonbelasting. De conclusie van het onderzoek is dat de regeling doeltreffend en doelmatig is.

Het onderzoeksrapport is op 5 juli 2023 naar de

Terechte terugvordering uitbetaalde GLB-subsidie

Een akkerbouwer had in 2018 in de Gecombineerde opgave verzocht om uitbetaling van de basis- en vergroeningsbetaling. Begin 2019 werd het uitbetalingsbedrag vastgesteld op bijna € 21.000. In maart 2021 vorderde RVO echter € 7.700 terug. Bij

Rechtbank: voormalige bedrijfswoning terecht omgezet naar plattelandswoning

De nieuwe eigenaar van een perceel met een (voormalige) bedrijfswoning startte een procedure om de bestemming te wijzigen van agrarisch naar wonen. Naar aanleiding van een door de voormalige eigenaren (hierna: eisers) van het perceel ingediende

Rechtbank verbiedt gebruik gewasbeschermingsmiddelen door lelieteler

De omwonenden van een akker, waarop een lelieteler lelies wilde gaan telen, vreesden voor schadelijke gevolgen voor hun gezondheid vanwege het veelvuldige gebruik van gewasbeschermingsmiddelen. Ze vonden de door de teler aangedragen maatregelen om de

Uiterste startdatum eco-activiteit weidegang uitgesteld

De uiterste datum om te starten met weiden voor veehouders, die deelnemen aan de eco-activiteit verlengde weidegang, is voor dit jaar verplaatst van 15 mei naar 1 juni. Dit heeft Stichting Weidegang in overleg met RVO besloten. Reden voor het uitstel

Uitvoeringstoetsen amendementen op Belastingplan 2024

De staatssecretaris van Financiën heeft de uitvoeringstoetsen bij de amendementen op het Belastingplan 2024 naar de Tweede Kamer gestuurd.

Bedrijfsopvolgingsregeling en doorschuifregeling aanmerkelijk belang

Als gevolg van het amendement

Tussentijds beëindigen arbeidsovereenkomst voor bepaalde tijd

Een arbeidsovereenkomst voor bepaalde tijd kan alleen tussentijds worden opgezegd als dat recht schriftelijk is overeengekomen en voor beide partijen geldt. Een werknemer heeft geen recht op WW als de arbeidsovereenkomst voor bepaalde tijd

Dien Gecombineerde opgave uiterlijk 15 mei in

De Gecombineerde opgave zal uiterlijk 15 mei ingediend moeten worden. De in het verleden geldende ‘kortingsperiode’ geldt in het huidige GLB-stelsel niet meer. Na 15 mei kunnen ook geen eco-activiteiten meer toegevoegd worden. Het is daarom raadzaam

Onbekwaamheid werknemer geen dringende reden voor ontslag op staande voet

Ontslag op staande voet is een uiterste maatregel en moet daarom aan strenge voorwaarden voldoen. Het ontslag moet berusten op een dringende reden, waardoor van de werkgever niet kan worden gevraagd de dienstbetrekking te laten voortduren. Het

Niet-verhuurde woning in box 3

Een inwoner van Zweden is eigenaar van een woning in Nederland. De woning is puur voor eigen gebruik en wordt niet verhuurd. De opbrengst van de woning is nihil. De inspecteur is van mening dat voor de belastingheffing in box 3 van de

Ontwerpbesluit met uurprijzen kinderopvang 2025

De minister van SZW heeft een ontwerpbesluit met aanpassingen in de kinderopvangtoeslag voor internetconsultatie gepubliceerd. Het besluit past de toeslagpercentages, maximum uurprijzen en toetsingsinkomens van de kinderopvangtoeslag voor 2025 aan.

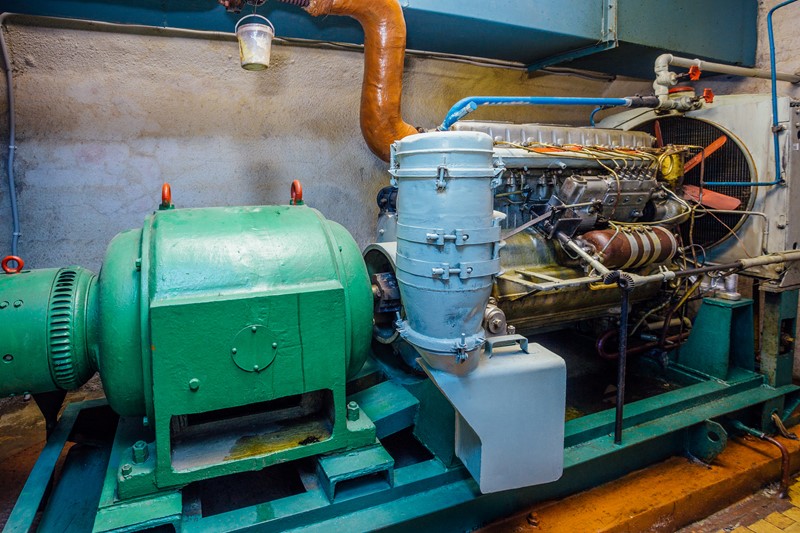

Noodsysteem kunstmatige ventilatie verplicht vanaf 1 juli 2024

In een stal met alleen kunstmatige ventilatie is vanaf 1 juli 2023 de aanwezigheid van een alarmsysteem en een alarmplan verplicht. Vanaf 1 juli 2024 moet in deze stallen ook een noodstroomaggregaat aanwezig zijn, dat ervoor zorgt dat het

Stuiten verjaring PAS-schade

Een vordering tot vergoeding van schade verjaart na vijf jaar. Na deze termijn kan geen aanspraak meer gemaakt worden op een schadevergoeding op basis van een onrechtmatige daad. Wij hebben eerder bericht dat dit voor PAS-melders betekent dat zij

Vaststelling rendementspercentage box 3 banktegoeden en schulden voor 2023

Op een moment, waarop een groot deel van de belastingplichtigen de aangifte IB voor het jaar 2023 heeft ingediend, heeft de staatssecretaris de forfaitaire rendementspercentages in box 3 voor banktegoeden en schulden vastgesteld. Dat gebeurt met

Geen ingekomen werknemer

De 30%-regeling is op verzoek van toepassing op een ingekomen werknemer met een specifieke deskundigheid, die op de Nederlandse arbeidsmarkt schaars is. De regeling is alleen van toepassing als de werknemer uit een ander land is aangeworven en die

Verkoop woningbouwkavels belast met btw?

Een tuinbouwer zag zich door een wijziging van het bestemmingsplan gedwongen om zijn activiteiten te beëindigen. Met de gemeente heeft hij een overeenkomst gesloten waarbij hij zich verplichtte zijn bedrijfsgebouwen te saneren. De tuinbouwer ontving

Was een verbouwing zo ingrijpend dat in wezen nieuwbouw is ontstaan?

Een ondernemer heeft een pand gekocht nadat dit was verbouwd tot hotel. De vraag is of de aanpassingen aan het pand zo ingrijpend zijn geweest dat in wezen nieuwbouw heeft plaatsgevonden. In dat geval is de latere levering niet belast met

Proceskostenvergoeding

Een belanghebbende is het niet eens met de toegekende proceskostenvergoeding en gaat in beroep. Uiteindelijk belandt de zaak bij de Hoge Raad. De rechtsvraag is of de proceskostenvergoeding juist is vastgesteld.

Artikel 8:75 Awb

Artikel 8:75 van de

Aanpassing Gecombineerde opgave vanwege niet-productief bouwland

Voor het ontvangen van GLB-premies geldt onder meer de eis dat 4% van het bouwland niet-productief gelaten moet worden. Hiervoor gelden enkele vrijstellingen. De 4%-eis kan ingevuld worden met o.a. aanliggende landschapselementen, bufferstroken en

Opgeven fosfaattoestand percelen in Gecombineerde opgave

Op gronden met een lagere fosfaattoestand mag, afhankelijk van de fosfaattoestand van het perceel, extra fosfaat gebruikt worden (fosfaatdifferentiatie). Daarvoor moet de fosfaattoestand van de percelen uiterlijk 15 mei opgegeven worden in de

Kabinet wil verbod op contante betalingen boven € 3.000

Het wetsvoorstel plan van aanpak witwassen omvat een verbod op contante betalingen boven € 3.000. Het wetsvoorstel is door de Tweede Kamer controversieel verklaard nadat het kabinet is gevallen. De ministers van Financiën en van Veiligheid en

Geen extra verhoging minimumloon per 1 juli, wel indexering

De Eerste Kamer heeft het wetsvoorstel met een extra verhoging van het wettelijke minimumloon per 1 juli 2024 verworpen. De reguliere halfjaarlijkse indexering van het minimumloon gaat wel door. Per 1 juli stijgt het minimumuurloon met 3,09% tot

Kamerbrief over toekomstig stelsel box 3

De staatssecretaris van Financiën heeft een brief aan de Tweede Kamer gestuurd over de ontwikkelingen rond de belastingheffing in box 3 van de inkomstenbelasting. In de brief gaat de staatssecretaris in op de aankomende arresten van de Hoge Raad over

Schadevergoeding PAS-melders

Bedrijven die tussen 1 juli 2015 en 29 mei 2019 een PAS-melding hebben gedaan, kunnen bepaalde schades vergoed krijgen van de overheid. Door de uitspraak van de Raad van State op 29 mei 2019 was voor deze bedrijven alsnog een volledige vergunning

Hoger budget Lbv/Lbv-plus, langere openstelling Lbv-plus

Het budget voor de Landelijke beëindigingsregeling veehouderijlocaties voor stikstofreductie (Lbv) en de Landelijke beëindigingsregeling veehouderijlocaties met piekbelasting (Lbv-plus) is verhoogd tot bijna € 1,45 miljard. Daarnaast is de

Verdeling van aftrekposten door fiscale partners kan later aangepast worden

Een echtpaar woonde met hun twee kinderen in een eigen woning. De eigen woning is gefinancierd met een hypothecaire lening. In hun aangiften inkomstenbelasting over 2018 hebben de echtgenoten de negatieve inkomsten uit de eigen woning zodanig

Fiscale risico’s bij schuiven met panden: wat u moet weten

In de complexe wereld van belastingen en onroerend goed kan het schuiven met panden aanzienlijke fiscale gevolgen met zich meebrengen. Het is essentieel om goed geïnformeerd te zijn over de potentiële risico's voordat u besluit tot een

Gevolgen verliesverrekening voor aanslag waarmee verlies is verrekend

Een ondernemer leed in 2018 verlies. De inspecteur heeft het vastgestelde verlies bij beschikking verrekend met de aanslag inkomstenbelasting over 2015. In reactie op de beschikking verliesverrekening vragen de ondernemer en zijn fiscale partner de

Loon of schenking?

Loon is een ruim begrip en omvat alles wat uit een dienstbetrekking wordt genoten. Vergoedingen en verstrekkingen in het kader van de dienstbetrekking worden tot het loon gerekend. Voor de beoordeling of sprake is van loon, is van belang of er een

Aanpassing besluit internationale waardeoverdracht van pensioen

Naar aanleiding van twee arresten van het Hof van Justitie EU heeft de staatssecretaris van Financiën een besluit over de internationale waardeoverdracht van pensioen aangepast. Door de wijziging zijn twee eerder gestelde voorwaarden aan de

Alternatieve dekkingsopties voor maatregelen uit Belastingplan 2024

Bij de behandeling van het Belastingplan 2024 heeft de Eerste Kamer inhoudelijke bezwaren geuit tegen vijf daarin opgenomen maatregelen. Het betreft de wijziging van de 30%-regeling, de afschaffing van de inkoopvrijstelling in de dividendbelasting,

Regelgeving scheuren grasland

Voor het scheuren, doodspuiten of vernietigen van grasland gelden afhankelijk van de grondsoort verschillende perioden, waarin dit is toegestaan en gelden verschillende voorwaarden. Hieronder volgt een overzicht van de regelgeving die geldt voor het

Vestigingssteun jonge landbouwers op 3 juni opengesteld

Er wordt tot 2027 € 240 miljoen beschikbaar gesteld voor jonge landbouwers, die een bedrijf geheel of gedeeltelijk overnemen of een bedrijf starten. De zogenaamde vestigingssteun wordt voor het eerst opengesteld van 3 juni tot en met 2 augustus

Internetconsultatie aanpassing kavelruilvrijstelling overdrachtsbelasting

Er geldt een vrijstelling van overdrachtsbelasting voor de verkrijging van grond in het kader van een kavelruil. De kavelruilvrijstelling is bedoeld om het landelijk gebied beter in te richten. De vrijstelling kan benut worden om de

Omvang administratie- en bewaarplicht ondernemers

Tijdens een boekenonderzoek bij een ondernemer heeft de inspecteur verzocht om inzage in de privé-agenda’s van de ondernemer. Dit verzoek is gedaan nadat de ondernemer had verklaard dat hij afspraken met klanten en voor klanten verrichte

Moeten alle op de zaak betrekking hebbende stukken worden opgestuurd?

De heffingsambtenaar heeft een aanslag onroerendezaakbelastingen opgelegd. De belanghebbende is het met de hoogte van de WOZ-waarde niet eens en vraagt de heffingsambtenaar om een schriftelijke onderbouwing van de waarde. De heffingsambtenaar zet de

Fiscale migratie: waar is thuis?

Een belastingplichtige emigreerde in 2015 naar Duitsland, althans dat meent hij. De inspecteur stelt echter dat de belastingplichtige fiscaal nog steeds in Nederland woont en corrigeert de aangifte inkomstenbelasting door het opleggen van een